GTmetrix is operated by WP Media SAS, a French company registered for VAT in various countries to comply with local tax regulations.

Our VAT Details

- France

- VAT: FR43800260648

- Canada

- GST: 77733 7361 RT0001

- SK PST: 8158362

Who is Charged VAT?

VAT will be charged to users in the following circumstances:

- Users in qualifying countries (EU/UK) that do not provide a valid VAT number

- Non-EU users in countries where local VAT/GST/PST regulations apply

If you have a valid VAT number, please make sure to update your billing details in your GTmetrix account to avoid unnecessary charges.

Note: VAT exemption is only applicable to certain countries.

Below is a list of countries that will have VAT included in subscription pricing.

EU Region

| Country | Country Code | Standard Rate |

| Austria | AT | 20% |

| Belgium | BE | 21% |

| Bulgaria | BG | 20% |

| Croatia | HR | 25% |

| Cyprus | CY | 19% |

| Czech Republic | CZ | 21% |

| Denmark | DK | 25% |

| Estonia | EE | 24% |

| Finland | FI | 25.50% |

| France | FR | 20% |

| – Martinique | MQ | 8.5% |

| – Réunion | RE | 8.5% |

| – Guadeloupe | GP | 8.5% |

| Germany | DE | 19% |

| Greece | GR | 24% |

| Hungary | HU | 27% |

| Ireland | IE | 23% |

| Italy | IT | 22% |

| Latvia | LV | 21% |

| Lithuania | LT | 21% |

| Luxembourg | LU | 17% |

| Malta | MT | 18% |

| Netherlands | NL | 21% |

| Northern Ireland | XI | 20% |

| Poland | PL | 23% |

| Portugal | PT | 23% |

| Romania | RO | 21% |

| Slovakia | SK | 23% |

| Slovenia | SI | 22% |

| Spain | ES | 21% |

| Sweden | SE | 25% |

Non-EU Region

| Country | Country Code | Standard Rate |

| Canada | CA |

AB – 5% GST BC – 5% GST / 7% PST MB – 5% GST / 7% PST NB – 15% HST NL – 15% HST NS – 15% HST ON – 13% HST PE – 15% HST QC – 5% GST / 9.975% QST SK – 5% GST / 6% PST NT – 5% GST NU – 5% GST YT – 5% GST |

| Egypt | EG | 14% |

| Norway | NO | 25% |

| Switzerland | CH | 8.10% |

| United Kingdom (Great Britain) | GB | 20% |

How to Update Your VAT Number

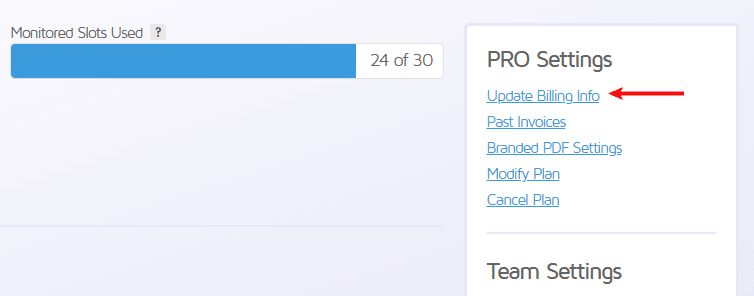

As a PRO subscriber, you can update your VAT number in your Billing Info by visiting your Account page, and clicking Update Billing Info.

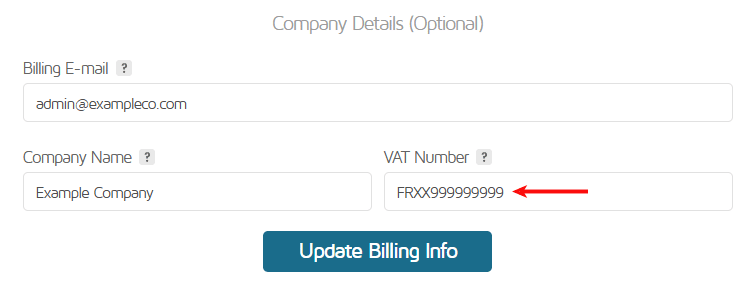

Scroll down to the “Company Details (Optional)” section and input your VAT number in the provided field. Click on Update Billing Info.

Our payment system will validate your VAT number and if successful, VAT will be excluded from your invoice. Note that VAT exemption is only applicable to certain countries.

Contact

If you have any questions regarding VAT/Taxes, please contact us and our billing team will be happy to assist you.